- The Daily Trade

- Posts

- 📊 Foreclosure signals real estate woes

📊 Foreclosure signals real estate woes

Hi everyone, here is your 📊 Daily Trade.

Here's what's happening today:

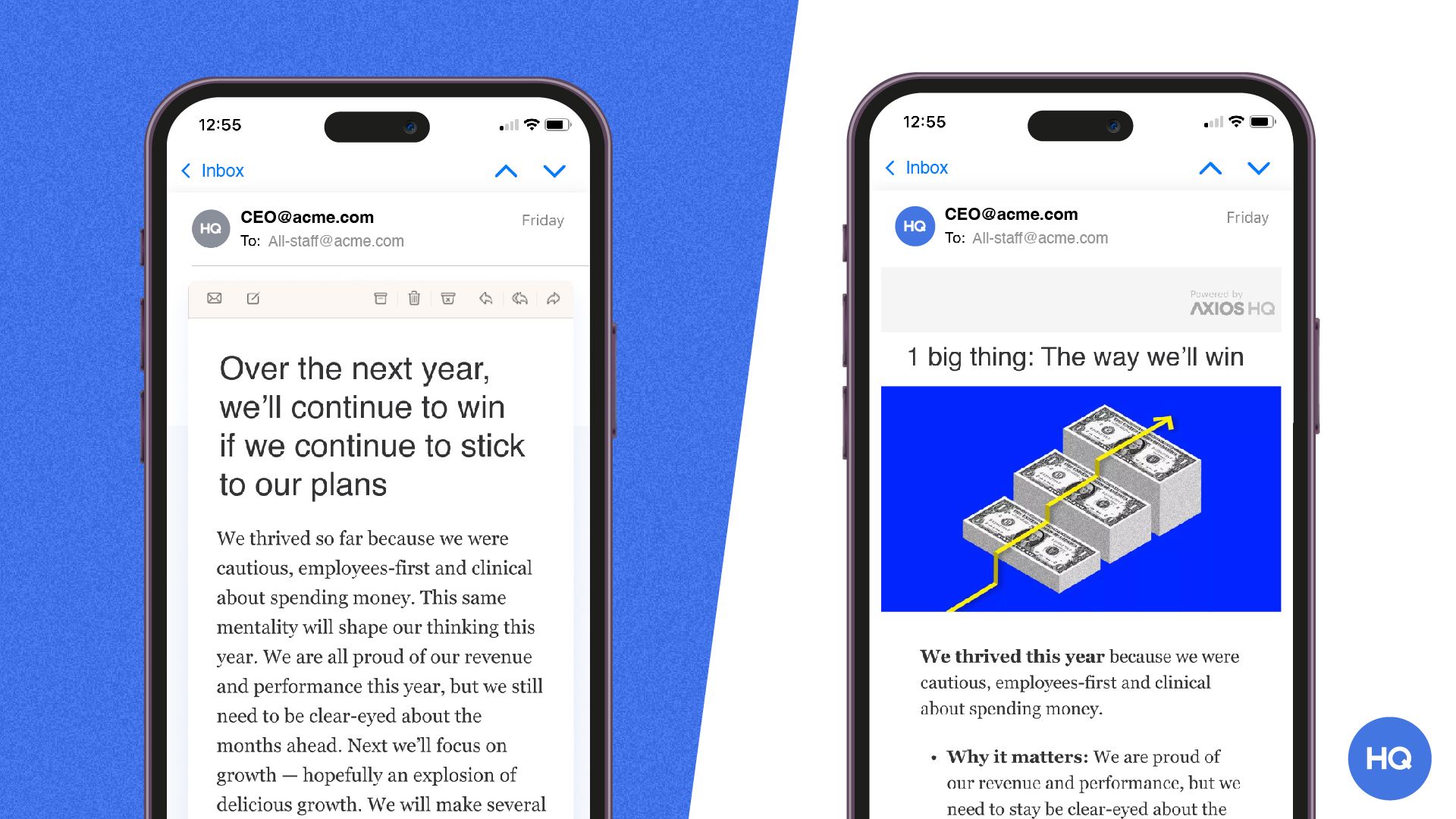

Six resources. One skill you'll use forever

Smart Brevity is the methodology behind Axios — designed to make every message memorable, clear, and impossible to ignore. Our free toolkit includes the checklist, workbooks, and frameworks to start using it today.

📉 US Consumer Spending Slows as Inflation Bites Link

|

🔨 US Steel to Reopen Illinois Plant Amid Rising Demand Link

|

🏢 Foreclosure of East Bay Office Hub Signals Market Woes Link

|

🔄 FirstEnergy Offers Exchange for Senior Notes Link

|

💰 Capricor Therapeutics Prices $150M Public Stock Offering Link

|

Don’t get SaaD. Get Rippling.

Remember when software made business simpler?

Today, the average company runs 100+ apps—each with its own logins, data, and headaches. HR can’t find employee info. IT fights security blind spots. Finance reconciles numbers instead of planning growth.

Our State of Software Sprawl report reveals the true cost of “Software as a Disservice” (SaaD)—and how much time, money, and sanity it’s draining from your teams.

The future of work is unified. Don’t get SaaD. Get Rippling.

Other news & articles you might like

- 💼 USCB Financial restructures portfolio for growth (Link)

- 🏦 Citizens expands private banking to Philadelphia (Link)

- 🚨 Whistleblower suit against Morgan Auto Group in Florida (Link)

- 📉 13 million US households have negative net worths (Link)

- 🔋 Sunrise granted patent for fast-charging tech (Link)

- 🌍 Colorado families shift from coal to geothermal (Link)

- 📊 NextEra Energy hosts investor conference on Dec. 8 (Link)

- ⚽ California lawmakers concerned over World Cup issues (Link)

You might also like…

We’re always looking for opportunities to bring our readers more value so we’ve partnered with a handful of companies that we think you might enjoy.

Want to explore other newsletters? Here are some newsletters our readers love

Are you ready to take your first step into crypto? Kraken makes it simple.

Do you have an idea for a new website or mobile app? Contact Modern Launch

How would you rate today's newsletter?If there's anything I can do better, please reply to this email and let me know! |