- The Daily Trade

- Posts

- Market Moves: Tesla's Ambitious Plans, Target's Tumble, and Nvidia's Boost

Market Moves: Tesla's Ambitious Plans, Target's Tumble, and Nvidia's Boost

(Sponsor)

Discover a generational opportunity to invest in Alaska's energy riches.

Klondike Royalties offers access to an estimated 300 million barrels of recoverable oil reserves in the Cook Inlet. Our royalty structure is designed to provide potential for steady returns.

How can we improve our newsletter's content?Your feedback is really important to us. We would really appreciate if you'd take a moment to let us know how we can bring you more value. |

Recent Headlines

Technical Analysis Results

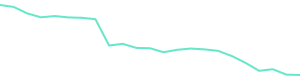

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

We recently compiled a list of the 10 Best Genomics Stocks To Buy Right Now. In this article, we are going to take a look at where Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) stands against the other genomics stocks. Genomics is the study of genes and how they function. Many rapidly growing companies are emerging in the genomics […]

Bronte Capital, an investment management company, released its “Amalthea Fund” third-quarter 2024 investor letter. A copy of the letter can be downloaded here. The fund was down 3.72% for the quarter vs. +2.54% for the MSCI ACWI (in $A). It was down 5.59% in September vs. -0.35% for the index. The market rose in the […]

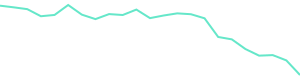

RSI Buy | MFI Hold | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Buy | STOCH Buy |

FMX sells its refrigeration and food service operations to Mill Point Capital, aiming to enhance long-term value by focusing on core business areas.

MONTERREY, Mexico, Nov. 04, 2024 (GLOBE NEWSWIRE) -- Fomento Económico Mexicano, S.A.B. de C.V. (“FEMSA” or the “Company”) (NYSE: FMX; BMV: FEMSAUBD, FEMSAUB) announced today the successful closing of its previously disclosed divestiture on July 17, 2024, with Mill Point Capital LLC, of its refrigeration and foodservice equipment operations, Imbera and Torrey, for a total amount of $8,000 million pesos, on a cash-free, debt-free basis. About FEMSAFEMSA is a company that creates economic and soci

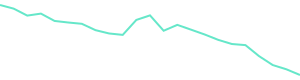

RSI Buy | MFI Buy | WillR Buy | AO Hold |

CCI Buy | BBANDS Buy | ULTOSC Buy | STOCH Buy |

Key Insights Using the 2 Stage Free Cash Flow to Equity, Academy Sports and Outdoors fair value estimate is US$70.98...

Earnings results often indicate what direction a company will take in the months ahead. With Q2 behind us, let’s have a look at Sportsman's Warehouse (NASDAQ:SPWH) and its peers.

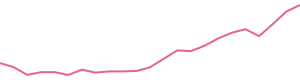

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Hold |

Nvidia stock falls ahead of earnings from the maker of artificial-intelligence chips, while Target misses profit expectations and the retailer’s shares drop sharply.

FOX vs. NFLX: Which Stock Is the Better Value Option?

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

ATLANTA, November 20, 2024--Assurant, Inc. (NYSE: AIZ), a leading global business services company that supports, protects, and connects major consumer purchases, today announced the appointment of Kevin Warren, former chief marketing and customer experience officer at UPS, to its Board of Directors, effective January 15, 2025. Warren will serve on the company’s Compensation and Talent committee.

AIZ's 11% dividend hike bears testimony to its solid capital position and uninterrupted cash flow supporting wealth distribution.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Hold |

YPF Sociedad Anonima (YPF) has released an update. YPF Sociedad Anonima reported a significant financial performance for the third quarter of 2024, with revenues reaching $5.3 billion, a 17.6% increase year-over-year, driven by higher natural gas sales, increased shale production, and rising local fuel prices. Adjusted EBITDA rose by 47% from the previous year, reflecting robust shale oil output and improved local fuel prices despite challenges from extreme weather in Patagonia. The company also

YPF SA (YPF) reports a nearly threefold increase in net income and a significant rise in shale oil production, despite facing cash flow and cost challenges.

We want to hear from YOU!

Your feedback is important to us. We’re always looking for ways to improve and would love to hear your thoughts on how we can make this newsletter even better for you. Whether you have suggestions, ideas, or just want to share what you enjoy most, we’re all ears.

Simply reply to this email with your thoughts. Every comment helps us serve you better.

Thank you for being a valued reader.

How would you rate today's newsletter?If there's anything I can do better, please let me know so I can make improvements! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.