- The Daily Trade

- Posts

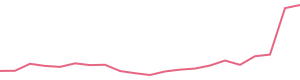

- Musk's Pay Package Setback, Salesforce's Mixed Earnings, and Rising Job Openings

Musk's Pay Package Setback, Salesforce's Mixed Earnings, and Rising Job Openings

Got NFL Season Tickets? Score Some Extra Cash With Lysted.

You’re the guy with the NFL season tickets, living the dream. But even the biggest fans miss a game or two. Instead of losing out, why not cash in? Lysted makes it easy to sell your NFL tickets on major sites like StubHub and Ticketmaster, all with just one listing. Forget the headaches of managing multiple platforms—Lysted does it for you, ensuring your tickets get sold fast, without the hassle.

Recent Headlines

Technical Analysis Results

RSI Sell | MFI Sell | WillR Sell | AO Hold |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

On Tuesday, Novocure[ticker symb=NVCR] stock got a positive adjustment to its Relative Strength (RS) Rating, from 73 to 96. The oncology company had some good news Monday announcing success in its pancreatic cancer study.

Novocure stock soars 49% as the late-stage study of TTFields therapy for treating pancreatic adenocarcinoma meets the primary endpoint of overall survival.

RSI Buy | MFI Hold | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Hold | STOCH Buy |

We recently published a list of 10 Best Extremely Profitable Stocks to Buy Now. In this article, we are going to take a look at where XP Inc. (NASDAQ:XP) stands against other best extremely profitable stocks to buy now. Can the S&P Hit 7,000 By the End of 2025? Ed Yardeni, president of Yardeni Research, […]

As the U.S. stock market navigates mixed signals ahead of key inflation data, with the Dow Jones Industrial Average recently surpassing 45,000 points for the first time, investors are keenly focused on how these developments might influence their portfolios. In such a dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to balance growth with consistent returns.

RSI Hold | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

In this article, we’ll summarize a bullish thesis posted on VIC covering Mueller Industries, Inc. (MLI) in late July when MLI stock was trading at $70. Currently, MLI stock is trading at $88.68, which is near its 52-week high of $96.81. So, MLI stock has gained over 26% since the publication of this thesis. MLI […]

Texas Pacific Land will join the S&P 500 index on Nov. 26, replacing Marathon Oil. Atlas Energy will move into the S&P SmallCap 600.

RSI Sell | MFI Hold | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Hold |

Over the past five decades, Advanced Micro Devices, or AMD (AMD), has become a staple of the tech industry. Let's take a closer look at the semiconductor company's biggest moments with Beyond the Ticker. 1969 AMD was founded by Jerry Sanders and a group of seven other individuals. 1972 The company went public on September 27, 1972, at $15.50 per share, bringing in a a total of $7.5 million. 1982 AMD and its main competitor Intel (INTC) signed a 10-year technology exchange agreement, as part of a deal to supply chips to IBM (IBM). 1991 AMD released the Am386, its version of the Intel 386 microprocessor, leading to a legal battle between the two companies. 1994 AMD landed a major deal with Compaq to supply Am486 processors to power Compaq PCs. 1996 AMD purchased NexGen for $857 million in stock, to take on Intel’s Pentium line of chips. 1999 AMD introduced the Athlon processor, the first 1-GHz microprocessor. 2003 AMD launched the Opteron, the company's first server-oriented processor. 2006 AMD acquired ATI Technologies for $5.4 billion, pushing ahead into the graphics card business for high-end gaming and design PCs. 2009 Intel agreed to paid AMD $1.25 billion as part of the pairs’ long-running antitrust battle. 2013 Microsoft (MSFT) and Sony (SONY) chose AMD as the chip provider for the Xbox One and PS4 game consoles. 2017 AMD debuted its new Ryzen line of chips aimed directly at taking on Intel’s top-of-the-line offerings. 2023 AMD acquired open-source AI software provider Nod.ai to boost its AI capabilities. Behind the AI wave, AMD hopes to continue riding this momentum well into the future. From tech giants to retail titans, Beyond the Ticker is a historical series that takes a deep dive into some of Wall Street's trending companies and how they transformed into the financial icons they are today. Check out more of our Beyond the Ticker series, and be sure to tune in to Yahoo Finance. Editor's note: This video was produced by Zach Faulds.

Whether you're a value, growth, or momentum investor, finding strong stocks becomes easier with the Zacks Style Scores, a top feature of the Zacks Premium research service.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Hold | STOCH Hold |

With 2025 quickly approaching, Wealth! Host Brad Smith takes a look at the best and worst performers of the S&P 500 since the start of 2024. The top-performing stocks in the index include Vistra (VST), Nvidia (NVDA), and Palantir (PLTR). On the other end, Walgreens Boots Alliance (WBA), Moderna (MRNA), and Dollar Tree (DLTR) are among the worst performers. Sector-wise, financials (XLF), communication services (XLC), and utilities (XLU) led the pack while real estate XLRE (XLRE), materials (XLB), and healthcare (^IXV) were among the laggards. To watch more expert insights and analysis on the latest market action, check out more Wealth here. This post was written by Naomi Buchanan.

S&P changes aim to better balance weights of large companies in ETFs.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Hold |

The credit rating agency switched Tapestry to stable from negative after it paid back $6.1 billion in debt taken on to complete the acquisition.

The holiday shopping season has arrived, kicking off with Black Friday promotions and deals being pushed by companies across industries. Former LVMH (MC.PA, LVMUY) Chairman of North America Pauline Brown joins Morning Brief to discuss consumer shopping patterns, particularly in the luxury goods sector. Brown notes a generational divide in shopping habits: older consumers are more than 50% likely to shop online and research products before visiting stores. In contrast, younger generations prefer in-store shopping, as "it's become a social activity again." However, luxury brand prices remain a significant concern for consumers. "This is not an issue that has just come to the fore this holiday season, this has been going on for about 5 years," Brown tells Yahoo Finance, noting that price inflation has exceeded 50% "for most luxury brands." She highlights two key factors driving this inflation: growing appetite for luxury brands which "seemed to be permission to raise the price," and previously strong growth in China, a key consumer market that has begun to see slowing demand for luxury goods. To watch more expert insights and analysis on the latest market action, check out more Morning Brief here. This post was written by Angel Smith

We want to hear from YOU!

Your feedback is important to us. We’re always looking for ways to improve and would love to hear your thoughts on how we can make this newsletter even better for you. Whether you have suggestions, ideas, or just want to share what you enjoy most, we’re all ears.

Simply reply to this email with your thoughts. Every comment helps us serve you better.

Thank you for being a valued reader.

How would you rate today's newsletter?If there's anything I can do better, please let me know so I can make improvements! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.