- The Daily Trade

- Posts

- Stock Market Technical Analysis: Today's Results | November 15, 2024

Stock Market Technical Analysis: Today's Results | November 15, 2024

Over 10,000 stocks analyzed, every day

At The Daily Trade, we analyze over 10,000 stocks every day using advanced technical indicators to pinpoint those that are overbought or oversold across multiple metrics. We deliver a curated list of stocks with actionable signals, so you can focus your attention on the ones that truly matter. Treat these signals as opportunities to dig deeper, identify key trends, and make more informed trading decisions. This daily insight is designed to give you an edge in the market—helping you stay ahead, spot trends early, and trade smarter.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

NEW YORK, Nov. 01, 2024 (GLOBE NEWSWIRE) -- Cornerstone Strategic Value Fund, Inc. (NYSE American: CLM) (CUSIP: 21924B302) and Cornerstone Total Return Fund, Inc. (NYSE American: CRF) (CUSIP: 21924U300), (individually the “Fund” or, collectively, the “Funds”), each a closed-end management investment company, announced that in keeping with each Fund’s previously adopted monthly distribution policy, each Fund is declaring the following distributions, which have been reset for the calendar year 202

NEW YORK, Aug. 02, 2024 (GLOBE NEWSWIRE) -- Cornerstone Strategic Value Fund, Inc. (NYSE American: CLM) (CUSIP: 21924B302) and Cornerstone Total Return Fund, Inc. (NYSE American: CRF) (CUSIP: 21924U300), (individually the “Fund” or, collectively, the “Funds”), each a closed-end management investment company, announced that in keeping with each Fund’s previously adopted monthly distribution policy, each Fund is declaring the following distributions: Record DatePayable DatePer ShareCLMOctober 15,

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

Great Place To Work® (GPTW) and Fortune magazine have honored Dow (NYSE: DOW) as one of the Fortune World's Best Workplaces™ in 2024 . This is the second consecutive year that Dow has earned this distinction.

Dow (NYSE: DOW), a leading global materials science company, and Guangdong Delian Group Co., Ltd. (Delian Group) signed a memorandum of understanding (MoU) at the 7th China International Import Expo. The two companies will collaborate to expand the application of post-consumer recycled (PCR) resins in the automotive market, supporting the industry's shift toward circularity.

RSI Buy | MFI Hold | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Buy | STOCH Buy |

The prospect of Kennedy leading HHS or a similar agency has cast major uncertainties over the health system.

Vaccine stocks slid late Thursday as reports stated noted anti-vaccine politician Robert Kennedy Jr. will serve as the next head of the Department of Health and Human Services.

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

Celanese's Elevated Debt, Earnings Risks Increase Financial Uncertainty, UBS Says

Deutsche Bank upgraded Celanese stock to "buy," saying yesterday's big selloff was overdone.

RSI Sell | MFI Sell | WillR Sell | AO Hold |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

A showdown between former heavyweight champion Mike Tyson and social media influencer-turned-fighter Jake Paul on Friday is the latest one-two punch from Netflix, as the media giant hopes to cash in on sports' sprint to streaming. The intergenerational showdown has all the makings of a crossover hit, with 58-year-old Tyson bringing in the old guard and 27-year-old Paul, who achieved early fame on YouTube, appealing to the younger, screen-toting social media junkies. Available to all of Netflix's more than 280 million subscribers for no additional fee, it could be a welcome change for American boxing fans accustomed to shelling out extra to watch marquee matches on long-time broadcaster HBO.

Netflix stock climbed to its seventh record high in as many trading days on Thursday after getting a bullish report from JPMorgan.

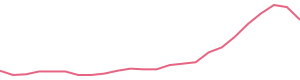

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Hold |

Able to appease investor sentiment toward its compelling growth narrative, Spotify Technology (SPOT) shares have rallied more than +15% since reporting Q3 results on Tuesday.

We recently compiled a list of the 10 Stocks on Jim Cramer’s Radar. In this article, we are going to take a look at where Spotify Technology S.A. (NYSE:SPOT) stands against the other stocks on Jim Cramer’s radar. Jim Cramer, the host of Mad Money, recently shared his outlook for Wall Street, focusing on earnings reports. […]

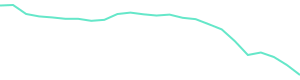

RSI Sell | MFI Hold | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

Insights from Tiger Global Management's Latest 13F Filing

The Trump rally is holding the bulk of last week's big gains. The last two Stock Of The Day picks are among five names flashing buy signals.

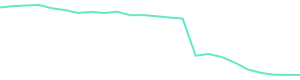

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

S&P changes aim to better balance weights of large companies in ETFs.

With concerns about inflation declining, investors are feeling increasingly confident about the global economy exiting the central bank interest rate hiking cycle without an economic downturn.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Hold |

Recently, Zacks.com users have been paying close attention to Toast (TOST). This makes it worthwhile to examine what the stock has in store.

It's already disrupting a massive industry.

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

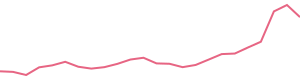

BILL Holdings ( NYSE:BILL ) First Quarter 2025 Results Key Financial Results Revenue: US$358.5m (up 18% from 1Q 2024...

Shares of payments and billing software maker Bill.com (NYSE:BILL) jumped 17.7% in the morning session after the company reported impressive third-quarter earnings which exceeded analysts' revenue and EPS estimates. The 19% year-over-year core revenue growth was driven by increased customer acquisition and higher payment volumes among newer cohorts, demonstrating the improved efficiency in converting new users. Operating income margin also improved, reflecting the company's ability to balance gr

We want to hear from YOU!

Your feedback is important to us. We’re always looking for ways to improve and would love to hear your thoughts on how we can make this newsletter even better for you. Whether you have suggestions, ideas, or just want to share what you enjoy most, we’re all ears.

Simply reply to this email with your thoughts. Every comment helps us serve you better.

Thank you for being a valued reader.

How would you rate today's newsletter?If there's anything I can do better, please let me know so I can make improvements! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.