- The Daily Trade

- Posts

- Market Moves: Profit-Taking and Election Aftermath Shake Up Stocks

Market Moves: Profit-Taking and Election Aftermath Shake Up Stocks

The Daily Trade delivers sharp, daily insights on the US stock market.

Start your day with a quick look at top market news, then dive into our technical analysis of over 10,000 stocks to uncover overbought and oversold opportunities.

Stay informed, spot trends, and trade with confidence— no fluff, just actionable intel.

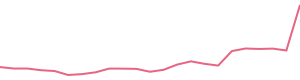

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

We recently compiled a list of the 10 AI News Making Waves Today. In this article, we are going to take a look at where Bloom Energy Corporation (NYSE:BE) stands against the other AI stocks that are making waves today. Is the AGI bubble about to burst? According to Margaret Mitchell, chief ethics scientist at the […]

Bloom Energy (BE) stock rallied Friday afternoon after the company announced a new deal with American Electric Power (AEP). Under the agreement, AEP will use Bloom's fuel cell technology to provide power solutions for artificial intelligence data centers. Market Domination Hosts Julie Hyman and Josh Lipton break down the details. To watch more expert insights and analysis on the latest market action, check out more Market Domination here. This post was written by Angel Smith

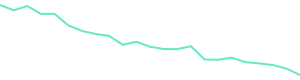

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

NASCAR signed a historic media rights extension last year worth $7.7 billion over seven years. The deal provides inventory to four broadcasters who will split 38 races across their channels each year starting with the 2025 season.

There's nothing wrong with Coca-Cola (NYSE: KO) as a company. Coke's biggest strength is that it is a dominant beverage maker. At the end of the day, beverages are just one tiny niche of the broader consumer staples sector.

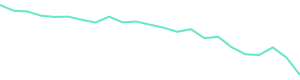

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Hold | STOCH Buy |

The excitement around the new weight-loss industry is overtaking other disease areas and portfolios for publicly traded companies.

Pfizer stock and other vaccine shares tumbled Friday morning after Trump picked Kennedy to lead the Department of Health and Human Services.

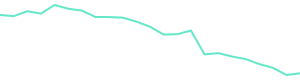

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

Unraveling the Financial Fabric and Strategic Directions of Lineage Inc

NOVI, Mich., November 06, 2024--Lineage, Inc. (NASDAQ: LINE) (the "Company"), the world’s largest global temperature-controlled warehouse REIT, today announced its financial results for the third quarter of 2024.

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

Key Insights Using the 2 Stage Free Cash Flow to Equity, Stanley Black & Decker fair value estimate is US$158 Stanley...

The tool maker is "preparing to discuss potential price increases."

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Hold | STOCH Buy |

Conagra Brands, Inc. (NYSE: CAG) today announced that it has been recognized on the 2024 Best for Vets: Employers list by Military Times. This recognition comes as the company continues to demonstrate its dedication to supporting veterans and active-duty service members, as well as their families, through strategic partnerships and internal initiatives.

Key Insights Given the large stake in the stock by institutions, Conagra Brands' stock price might be vulnerable to...

RSI Buy | MFI Buy | WillR Buy | AO Buy |

CCI Buy | BBANDS Hold | ULTOSC Buy | STOCH Buy |

The stock was sluggish on the back of Insight Enterprises, Inc.'s ( NASDAQ:NSIT ) recent earnings report. Along with...

CHANDLER, Ariz., November 06, 2024--Insight Enterprises (NASDAQ:NSIT) held the grand opening today in Fort Worth, Texas, of its latest Solutions Integration Center. The 250,000-square-foot facility serves clients across the United States and is powered by the latest technology, making it a paragon of modern warehouse operations. With AI-driven capabilities like autonomous mobile robotics and advanced logistics, it can achieve 10 times the shipping velocity of traditional IT fulfillment centers.

RSI Sell | MFI Sell | WillR Sell | AO Hold |

CCI Sell | BBANDS Sell | ULTOSC Sell | STOCH Sell |

This is what could happen next to Disney shares.

The Walt Disney Company ( NYSE:DIS ) insiders who purchased shares in the last 12 months were richly rewarded last...

RSI Sell | MFI Sell | WillR Sell | AO Sell |

CCI Sell | BBANDS Hold | ULTOSC Sell | STOCH Sell |

This software company has barely scratched the surface of its enormous addressable market.

BILL Holdings ( NYSE:BILL ) First Quarter 2025 Results Key Financial Results Revenue: US$358.5m (up 18% from 1Q 2024...

RSI Buy | MFI Hold | WillR Buy | AO Buy |

CCI Buy | BBANDS Buy | ULTOSC Hold | STOCH Buy |

President-elect Donald Trump has selected Robert F. Kennedy Jr. for the position of Secretary of Health & Human Services (HHS). The appointment has drawn significant attention due to Kennedy Jr.'s controversial stance on vaccines, including his designation as one of the "Disinformation Dozen" during the COVID-19 pandemic. Following the announcement, vaccine-related stocks experienced a notable decline. Yahoo Finance Senior Health Reporter Anjalee Khemlani analyzes the implications of this appointment and shares reactions from market analysts regarding its potential impact on the healthcare sector. To watch more expert insights and analysis on the latest market action, check out more Market Domination here. This post was written by Angel Smith

MRK in-licenses a bispecific antibody, based on the same mechanism as SMMT's lead drug, which outperformed its blockbuster drug, Keytruda, in a lung cancer study.

We want to hear from YOU!

Your feedback is important to us. We’re always looking for ways to improve and would love to hear your thoughts on how we can make this newsletter even better for you. Whether you have suggestions, ideas, or just want to share what you enjoy most, we’re all ears.

Simply reply to this email with your thoughts. Every comment helps us serve you better.

Thank you for being a valued reader.

How would you rate today's newsletter?If there's anything I can do better, please let me know so I can make improvements! |

Technical Indicator Information

Relative Strength Index (RSI) | Period: 14 days | Overvalued threshold: 70 | Undervalued threshold: 30

Money Flow Index (MFI) | Period: 14 days | Overvalued threshold: 80 | Undervalued threshold: 20

Williams Percent Range (WillR) | Period: 14 days | Overvalued threshold: -20 | Undervalued threshold: -80

Aroon Oscillator (AO) | Period: 14 days | Overvalued threshold: 75 | Undervalued threshold: -75

Moving Average Convergence/Divergence (MACD) | Period: 26/12/9 days | Overvalued threshold: MACD crosses below MACD Signal | Undervalued threshold: MACD crosses above MACD Signal

Stochastic Oscillator (STOCH) | Period: 14/3/3 days | Overvalued threshold: %K crosses below %D above 80 | Undervalued threshold: %K crosses above %D below 20

Commodity Channel Index (CCI) | Period: 20 days | Overvalued threshold: 100 | Undervalued threshold: -100

Bollinger Bands (BBANDS) | Period: 20 days | Overvalued threshold: price >= upper band | Undervalued threshold: price <= lower band

Parabolic Stop and Reverse (SAR) | Period: variable 50 - 100 days | Overvalued threshold: SAR crosses above price | Undervalued threshold: SAR crosses below price

Triple Exponential Average (TRIX) | Period: 15 days | Overvalued threshold: TRIX crosses below 0 | Undervalued threshold: TRIX crosses above 0

Ultimate Oscillator (ULTOSC) | Period: 28/14/7 days | Overvalued threshold: 70 | Undervalued threshold: 30

Directional Movement Index (DMI) | Period: 14 days | Overvalued threshold: PlusDI crosses below MinusDI | Undervalued threshold: PlusDI crosses above MinusDI

Average Directional Index (ADX) | Period: variable 14 days | Requirement: >= 25

Analysis is only performed on securities with market caps in excess of $100 million and with daily trade volume in excess of $50 million.

Disclaimers

The information in our newsletter is not intended to constitute investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described will be profitable. We strongly advise you to discuss your investment options with your financial advisor prior to making any investments, including whether any investment is suitable for your specific needs.

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The analysis provided in this newsletter is based on the prior trading day’s closing prices and may not reflect after-hours trading, earnings announcements, or other significant market events that occur outside regular trading hours. As such, any data or commentary may not fully capture the latest market movements or emerging factors. For the most current and comprehensive view, please consider additional sources or consult with a qualified financial professional.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. We reserve all rights to the content of this newsletter. Forwarding, copying, disseminating, or distributing this newsletter in whole or in part, including substantial quotation of any portion the publication or any release of specific investment recommendations, is strictly prohibited.